How to apply for SBI Fastag: Complete Guide

- 1SBI FASTag enables cashless toll payments with instant online recharges

- 2Apply and activate easily via SBI YONO app, portal, or authorised branches

- 324×7 helpline, auto top-up, and Full KYC offer seamless travel convenience

- What is SBI FASTag?

- SBI FAStag KYC Categories

- Documents needed for SBI FAStag application

- How to Apply for an SBI FAStag?

- How much do you have to pay for a SBI FAStag?

- How to Activate Your SBI FAStag?

- How to Check SBI FASTag Status:

- SBI FASTag Login and Account Management

- How to check your SBI FAStag balance?

- How to recharge the SBI FAStag?

- Benefits of the SBI Bank FAStag

- Common Issues and Troubleshooting

Highway travel earlier was associated with long waits at toll plazas and cash hassles.This problem, however, was tackled effectively by the government in 2014, with the launch of FASTag under the National Electronic Toll Collection (NETC) system. FASTag uses RFID technology to deduct toll charges automatically as you attempt to pass through a toll plaza, making your journey faster, smoother, and entirely cashless. FASTag in India was made mandatory for all vehicles since February 2021.

With so many banks offering FASTag, choosing the right one can be tricky. SBI FASTag, offered by the State Bank of India, is one of the reliable, secure, and convenient options for digital toll payments. This guide walks you through everything you need to know about SBI FASTag, including how to apply, recharge, manage your account, and reach customer support.

What is SBI FASTag?

SBI FASTag is an RFID-based tag that sticks to your vehicle’s windscreen. It lets toll charges be automatically deducted from your linked SBI FASTag wallet or bank account, so you can pass through toll plazas without stopping. This not only saves time and fuel but also ensures a hassle-free, contactless experience.

The tag is a small, rectangular sticker (10×5 cm) with multiple layers. When you drive through a toll plaza, RFID sensors read the tag, process the payment, and update your balance instantly. You can use SBI FASTag at all NETC-enabled national and state toll plazas across India.

SBI FAStag KYC Categories

When you apply for an SBI FASTag, you get to choose between two types of KYC: Limited KYC or Full KYC. Each option comes with its own benefits, limits, and document requirements, so you should pick the one that fits your needs.

Limited (Minimum) KYC FASTag

This is the basic version of FASTag. You only need a few documents, such as your PAN, a copy of your vehicle’s RC, and a passport-size photo.

However, this tag comes with certain restrictions.

- You can keep a maximum balance of ₹10,000

- You can reload only up to ₹10,000 per month (₹1,20,000 per year)

There’s one more rule: if you don’t upgrade to Full KYC within 24 months, your FASTag will stop accepting top-ups.

Full KYC FASTag

A Full KYC FASTag removes almost all loading limits. To complete this, you must provide full identity and address documents along with your RC and photo.

Once verified:

- You can store up to ₹2 lakh in your FASTag wallet

- There is no monthly cap on how much you can recharge

This makes Full KYC the better long-term option, especially if you travel frequently or want complete flexibility.

Documents needed for SBI FAStag application

When applying for SBI FASTag, you must submit the following (depending on KYC type):

- Vehicle documents: Valid Registration Certificate (RC) of the vehicle.

- KYC documents: Government ID and address proof (such as Aadhaar, PAN card, driver’s license, passport, voter ID, etc.)

- Photograph: A recent passport-size photo of the vehicle owner.

Note: Each vehicle needs a separate FASTag with the RC and KYC linked to that vehicle number

How to Apply for an SBI FAStag?

You can purchase an SBI FASTag online through the official website / SBI YONO Aopp or offline at select SBI branches, toll plazas, or authorised dealerships

Online Application Process

- Step 1: Visit the SBI FASTag Portal

Go to the official FASTag website (fastag.sbi.bank.in) or download the SBI YONO app.

- Step 2: Register or Log in

Use your mobile number to create an account or log in. Your registered mobile number acts as your login ID, and the system will send a default password via SMS.

- Step 3: Fill in the Application Form

Enter your personal and vehicle details, such as your name, address, vehicle number, and Registration Certificate (RC) information.

- Step 4: Upload Required Documents

Upload scanned copies or clear photos of your RC, identity and address proof, along with a passport-size photograph. SBI will verify these documents as part of KYC.

- Step 5: Make the Payment

Pay the applicable FASTag fees online, including the security deposit and a minimum recharge amount.

- Step 6: Receive Confirmation

Submit your form. You will get a confirmation via SMS, and the FASTag will be delivered to your registered address, usually within 7–10 business days.

Offline Application Process

- Step 1: Visit an SBI PoS or Branch

Go to a designated FASTag issuing centre, such as selected SBI branches, CSC centers, or toll plazas with SBI representatives. You can locate the nearest PoS through the FASTag portal.

- Step 2: Collect and Complete the Form

Fill in the FASTag application form with your vehicle and personal information.

- Step 3: Submit Your Documents

Provide photocopies of your KYC documents, vehicle RC, and a passport-size photo for verification.

- Step 4: Make the Payment

Pay the required FASTag charges at the counter. The agent will process your application after verifying the details.

- Step 5: FASTag Issuance and Activation

You may receive the FASTag sticker immediately, or it may be dispatched to your address. You will get an SMS once your FASTag is activated and ready for use.

How to Link SBI FASTag to Your Bank Account?

If you hold an SBI NETC FASTag (Prepaid), it functions like a prepaid wallet. You add money to this wallet, and toll charges are deducted directly from its balance.

You can recharge your FASTag wallet from any bank account, including SBI, using:

- Net banking

- Debit or credit card

- UPI

SBI also provides an auto top-up feature. You can link your SBI savings account and set up automatic recharges whenever the wallet balance drops below a set limit.

You can manage this setup easily through the SBI FASTag portal, YONO app, or BBPS platforms. These channels guide you to link your debit account or enable an e-mandate for smooth and timely wallet reloads.

Keep in mind that your FASTag always remains connected to your SBI FASTag prepaid wallet. Your responsibility is to ensure that the wallet has enough balance so toll deductions happen without any interruption

How much do you have to pay for a SBI FAStag?

SBI FASTag charges vary by vehicle class. As of September 2025, the issuance fee, security deposit and minimum balance for common vehicles are (see table below)

| Vehicle Type (Class) | Tag Cost | Security Deposit (Refundable) | Min. Balance | Total at Issuance |

| Car / Jeep / Van / Mini LCV (Class 4) | ₹100 | ₹200 | ₹100 | ₹400 |

| All other types of vehicles (LCV, Bus/ Truck, 3-axle, ≥4-axle, etc.) | ₹100 | ₹300 | ₹300 | ₹700 |

- Tag Cost: One-time RFID tag fee.

- Security Deposit: Refunded when FASTag is closed (assuming no dues).

- Min. Balance: The minimum wallet balance required to activate the tag (also considered part of the initial payment).

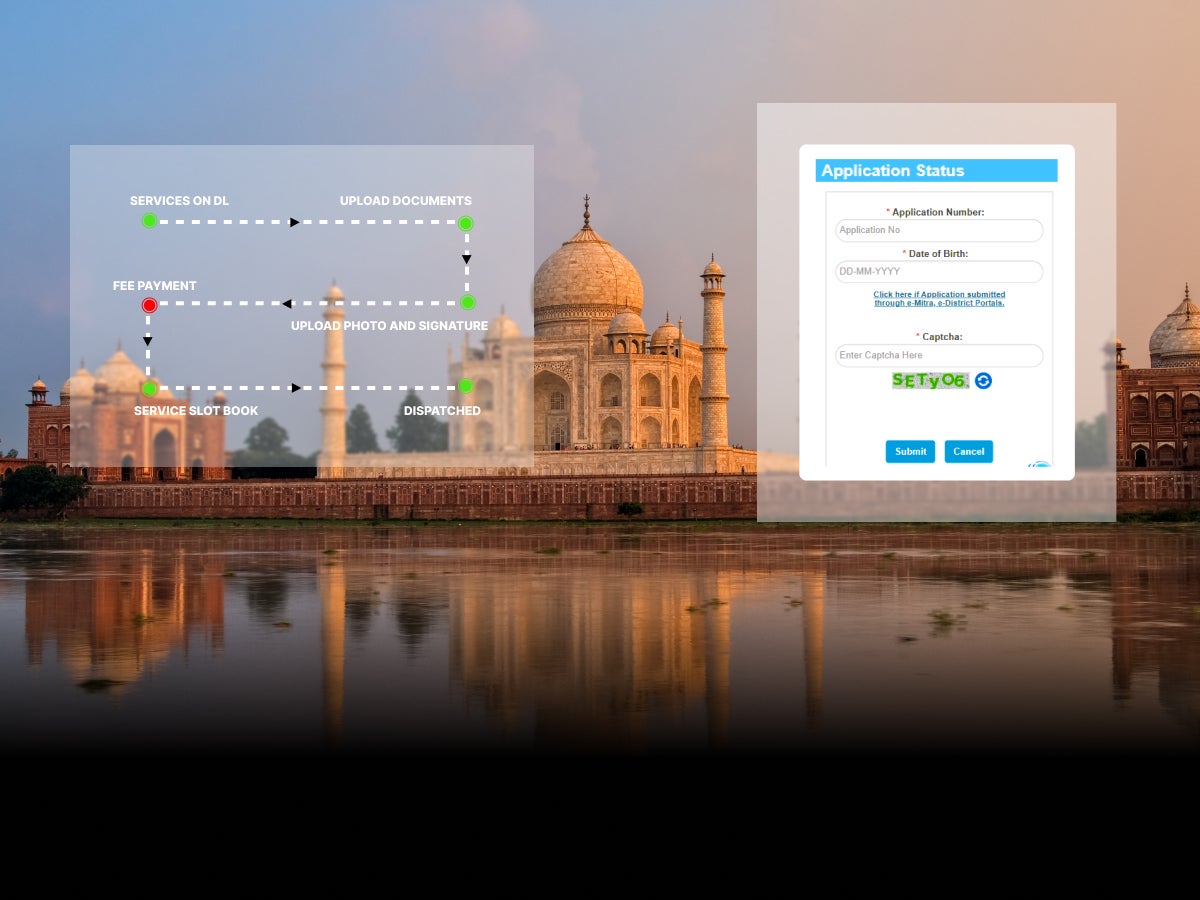

How to Activate Your SBI FAStag?

Here’s a step-by-step activation process for SBI FASTag:

- Receive the FASTag

Once you finish the application process (online or at a Point-of-Sale location), SBI either delivers the tag to your registered address or hands it over immediately at the PoS counter.

- Affix the FASTag properly on your vehicle

- Place the tag on the inside of your car’s windscreen, preferably near or behind the rear-view mirror. Make sure the vehicle number remains clearly visible and avoid placing the tag behind metallic tints or accessories, so toll scanners can read it without issues.

- Place the tag on the inside of your car’s windscreen, preferably near or behind the rear-view mirror. Make sure the vehicle number remains clearly visible and avoid placing the tag behind metallic tints or accessories, so toll scanners can read it without issues.

- Link the FASTag to your vehicle & complete KYC

After receiving the tag, you must activate it by linking it to your SBI account or a prepaid wallet. You can easily do this through the SBI FASTag portal or by visiting your nearest SBI branch. Ensure your linked account always has enough balance for toll deductions.

- Load initial balance

Keep at least the minimum required balance in your FASTag wallet, as per SBI’s guidelines. Without adequate funds, the tag may remain inactive or get blacklisted. You can recharge anytime using the SBI FASTag portal, mobile app, or UPI.

- Check activation status & use

- Once activation is complete, SBI sends you an SMS or notification. From here, you’re all set — drive through the FASTag lane at any toll plaza and the toll amount will be deducted automatically.

How to Check SBI FASTag Status:

- Portal/Email: Log in to the SBI FASTag portal to confirm whether your tag is marked as “Active.” SBI may also share updates over email or SMS once the activation is complete

- NETC Portal: Visit the NETC portal and enter your vehicle registration number. The portal displays all FASTags linked to that vehicle and their current status.

- Contact Support: If you still have doubts, call SBI FASTag customer care at 1800-11-0018. Provide your vehicle or application details, and the support team will help you with the activation status.

If your status doesn’t update immediately, wait a few days for processing before reaching out to customer support.

SBI FASTag Login and Account Management

The SBI FASTag portal gives you complete control over your FASTag account.

- Login Credentials

Your registered mobile number acts as your login ID, and SBI sends the initial password via SMS when the tag is issued. If you ever forget the password, you can reset it through the “Forgot Password” option on the portal.

- After You Log In

You can check your balance, view toll transaction history, and download statements anytime. The portal also lets you recharge your wallet, update your vehicle details, complete KYC upgrades, and even close or surrender the tag if required.

- Profile Management

You may update your personal information, upload KYC documents (when upgrading from minimum to full KYC), and link your savings account for auto top-ups, ensuring your FASTag always has a sufficient balance.

How to check your SBI FAStag balance?

Thanks to SBI’s wide network, there are multiple ways to check your balance:

Without Logging In

You don’t need to log in to the portal to know your balance:

- Missed Call: Dial 7208711111 from your registered mobile number, and you’ll receive an SMS with your current balance.

- SMS: Send an SMS with the text FTBAL (for your default vehicle) or FTBAL <VehicleNo> (if you have multiple tags) to 72088-20019. You’ll instantly get your balance via SMS.

These services are available 24×7 on the mobile number linked to your FASTag account.

Using the SBI FASTag Portal

- Visit the SBI FASTag portal and log in with your registered mobile number and password.

- Navigate to “Account Summary” or “Balance” to see your current FASTag balance.

- You can also access your full transaction history to track toll payments and other deductions.

Using the SBI YONO App

- Open the SBI YONO app and log in with your SBI online banking credentials.

- Go to the FASTag section under “Services” to view your balance and transaction details.

The YONO app is especially convenient if you already use it for your banking needs, letting you check your FASTag balance on the go.

How to recharge the SBI FAStag?

Keeping an eye on your FASTag balance and topping it up on time is essential to avoid hassles at toll plazas. SBI offers multiple convenient ways to recharge your FASTag, so you can choose the method that suits you best.

Recharge via Website

You can top up your FASTag directly on the SBI FASTag portal using net banking, debit/credit cards, or UPI:

- Visit the SBI FASTag portal and log in with your user ID and password.

- Click on Tag Recharge.

- Enter the amount you want to recharge and select Pay Now.

- Choose your preferred payment method.

- Confirm the details and complete the payment.

Recharge via YONO App

- Open the YONO app and log in.

- Go to YONO Pay and select FASTag under Quick Payments.

- Recharge your FASTag using the UPI option.

Recharge via Google Pay

- Open Google Pay and tap New.

- From Suggested Businesses, select More and then FASTag.

- Enter your bank details and tap Next.

- Review your account details and return to the home screen.

- Tap FASTag, enter the recharge amount, and confirm payment.

Recharge via PhonePe

- Open the PhonePe app and select FASTag Recharge.

- Enter your vehicle number and pick a payment method.

- Enter the recharge amount and complete the payment.

No matter which option you use, the amount is instantly credited to your SBI FASTag wallet, letting you drive through tolls without any interruptions.

Benefits of the SBI Bank FAStag

Cashless Toll Payment: Glide through toll plazas without stopping for cash. Tolls are deducted automatically, letting you save time and skip long queues.

Time and Fuel Savings: With FASTag, you avoid repeated stops, cutting down both travel time and fuel consumption.

Convenience: Recharge your FASTag anytime using banking apps or UPI. You can also check your toll transaction history, balance, and even apply for annual passes, all from the convenience of your mobile phone.

Environmental Benefits: Non-stop traffic reduces congestion and lowers vehicle emissions, making your drive greener.

Compliance: FASTag is mandatory by law. Using it helps you avoid fines or paying double tolls, giving you peace of mind.

Overall, SBI FASTag makes your toll experience smoother, faster, and hassle-free.

Common Issues and Troubleshooting

Tag Not Read / Blacklisted: Tags getting blacklisted is a common occurrence in India, happening generally due to low balance or incorrect lane usage. So, in case, if you are stopped at a toll plaza in a FASTag lane, first check that your FASTag has sufficient balance. Use the My FASTag app to check your tag’s status in real time: green = active, orange = low balance, red = blacklisted. If your tag is blocked or not reading, top up immediately or contact customer care. Always affix the tag as per instructions to avoid read errors.

Wrong Deduction: In some circumstances, it can happen that you are charged incorrectly, such as the wrong toll or a double charge gets deducted. In these cases, raise a dispute via SBI’s CRCF portal or customer care. SBI will initiate a chargeback with the toll operator on your behalf.

Recharge Failures: If your recharge doesn’t reflect in your FASTag account, file a complaint immediately through SBI’s CRCF portal. Banks may take up to 15 days to resolve the issue, though SMS or portal updates usually happen sooner.

FASTag Lane Fines: Entering a FASTag lane without an active tag can result in double tolls. Only vehicles with a valid FASTag should use these lanes. If you enter by mistake, you may need to pay extra.

In most cases, a quick top-up or a call to SBI support resolves common FASTag issues, letting you continue your journey without interruptions.

SBI FAStag Customer Care

If you need help or have questions, SBI offers multiple support channels for FASTag users:

Toll-Free Helpline: Call 1800-11-0018 for general queries or complaints. The helpline is available 24×7.

CRCF Portal: Register FASTag issues or complaints online via the Customer Complaint Registration portal.at https://crcf.bank.sbi/ccf (Customer Complaint Registration). This platform handles all FASTag-related grievances.

IHMCL / 1033 Helpline: For toll plaza issues, such as lanes not accepting FASTag, call 1033 (NHAI FASTag helpline).

Keep your FASTag customer ID and vehicle details ready when contacting support to get faster assistance.