West Bengal Road Tax Guide: Rates & Online Payment

Updated on: 2nd February, 2024 IST

Dotted with urban and cultural centres, roads in West Bengal are an essential part of keeping the flow of goods, transport, and people seamless. Similarly, the road tax system is vital to develop and maintain the infrastructure across the State.

If you’re a resident, it is crucial for you to know the working of the West Bengal road tax system. We’ve done the legwork for you to understand and pay road taxes online stress-free and within minutes!

Table of Contents

How is Road Tax Calculated in West Bengal?

The West Bengal road tax or transport vehicle tax has several components basis which taxes are imposed on vehicles within the State.

The actual road tax amount is levied based on the following:

- Vehicle type, such as 2-wheeler, 3-wheeler, 4-wheeler, bus, tractor, trailer, or other State vehicles.

- Purpose of use, such as for personal transportation, goods transportation, or passenger transportation.

- Vehicle model

- The vehicle’s seating capacity

- The vehicle’s engine capacity

- The vehicle’s ex-showroom price

Here’s how much road tax you need to pay in West Bengal:

Road Tax for Two-Wheelers

| Engine Capacity (in cc) | Road Tax in West Bengal (in ₹) |

| For engines up to 80cc rating | ₹1,560 |

| For engines between 80cc and 170cc rating | ₹3,125 |

| For engines between 170cc and 250cc rating | ₹ 4,685 |

| For engines over 250cc rating | ₹6,250 |

Road Tax for Four-Wheelers

| Engine Rating | Tax for Non-AC Vehicles | Extra Tax for AC Vehicles |

| Engines up to 900 cc | ₹10,550 | ₹4,000 |

| Engines between 900 cc and 1,490 cc | ₹13, 900 | ₹7,500 |

| Engines between 1,490 cc and 2,000 cc | ₹21,800 | ₹10,000 |

| Engines between 2,000 cc and 2,500 cc | ₹28,000 | ₹12,500 |

| Engines higher than 2,500 cc | ₹30,000 | ₹15,000 |

Road Tax for Commercial Vehicles

| Engine Capacity | Road Tax in West Bengal |

| Engine rating below 900 cc | ₹11,900 |

| Engine rating between 900 cc and 1,490 cc | ₹15,250 |

| Engine rating between 1,490 cc and 2,000 cc | ₹24,500 |

| Engine rating between 2,000 cc and 2,500 cc | ₹30,000 |

| Engine rating greater than 2,500 cc | ₹32,000 |

How to Pay Road Tax Online in West Bengal?

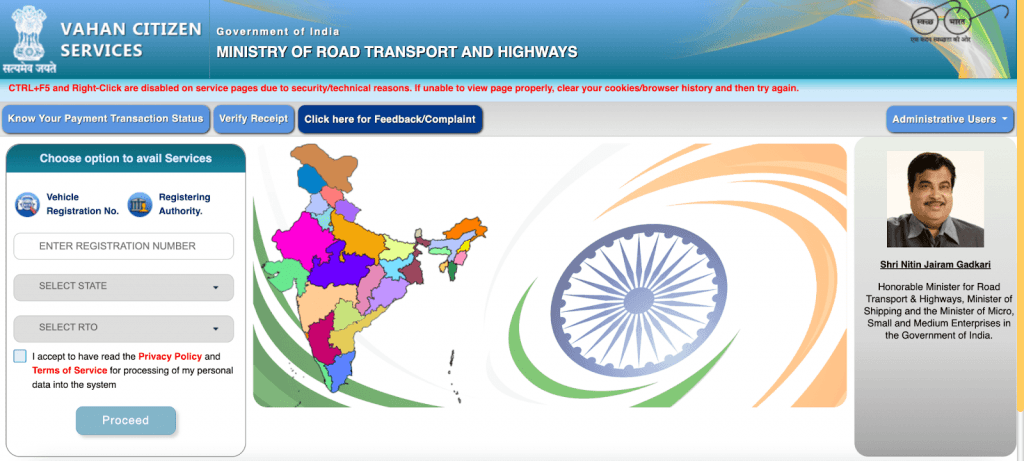

Paying road tax online in West Bengal is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

Step 1: Visit the Vahan Citizen Services Portal.

Step 2: Enter your vehicle’s registration number, State, and RTO.

Step 3: Click on ‘I accept’ followed by ‘Proceed.’

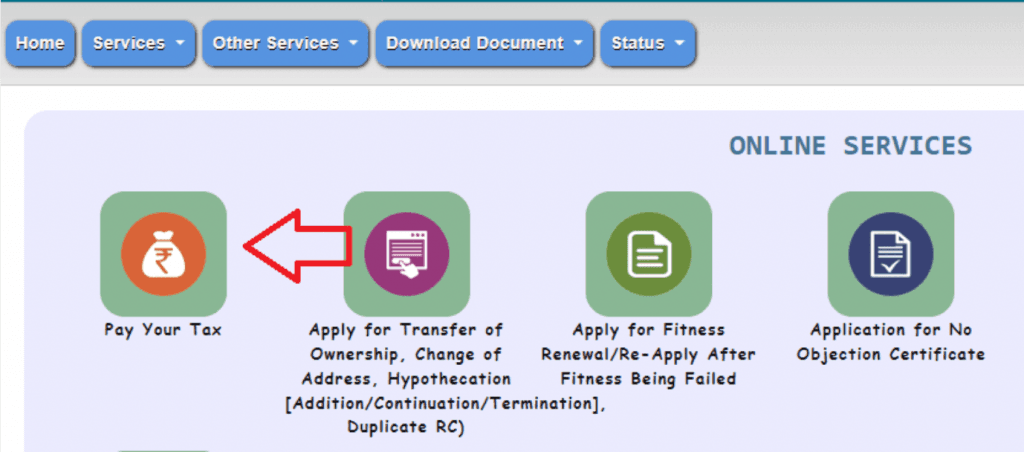

Step 4: Click on ‘Pay Your Tax.’

Step 5: Enter your registration number.

Step 6: Now you can pay your road tax through the payment gateway that appears on your screen.

Step 7: Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in West Bengal?

If you’ve failed to pay your road tax within the stipulated time, you will be penalised a certain additional amount based on the extent of delay.

| Delay | Additional Tax Applicable |

| Up to 15 days after lapse of the grace period | Not applicable |

| 16 to 45 days | 1/20th portion of the tax applicable |

| 45 to 74 days | 1/10th portion of the tax applicable |

| 75 days to 1 year | 1/5th portion of the tax applicable |

| 1 to 2 years | 2/5th portion of the tax applicable |

| 2 to 3 years | 3/5th portion of the tax applicable |

| 3 to 4 years | 4/5th portion of the tax applicable |

| Over 4 years | Full tax |

The Bottom Line

As we conclude this guide to pay your road tax online in West Bengal, we’re certain that you’re equipped with all the necessary information to do so seamlessly. However, if you get confused at any step along the way, feel free to come back to this blog and read through the steps again!

FAQs

Q: What vehicles are exempted from paying road tax in West Bengal?

A: Two and four-wheeled electric vehicles are exempted from paying in West Bengal.

Q: How often do I need to pay road tax in West Bengal?

A: You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q: Which State in India has the highest amount of road tax?

A: Karnataka charges the highest amount of road tax in India.

Q: Is the road tax refund process online?

A: Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q: Where can I check the status of road tax in West Bengal?

A: You can check the road tax status in West Bengal on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car