Arunachal Pradesh Road Tax Guide: Rates & Online Payment

Updated on: 20th February, 2024 IST

One of the most beautiful States among the ‘Seven Sisters’ in India, Arunachal Pradesh is known as ‘The Land of the Dawn-lit-Mountains.’ If you live in this culturally-diverse State or are planning to move there soon, you must understand the Arunachal Pradesh road tax system and pay your tax on time. Here’s a comprehensive guide to help you pay your Arunachal Pradesh road tax online seamlessly, and within minutes!

Table of Contents

How is Road Tax Calculated in Arunachal Pradesh?

Each State chooses different parameters and rules to levy road taxes. In Arunachal Pradesh, the motor vehicle tax is calculated based on factors like the vehicle’s type, length, and weight.

Road Tax for Two-Wheelers

| Vehicle weight | Rate of (one-time tax for 15 years) | For every 5 years after 15 years of tax |

| Less than 65 Kg | ₹1,200 | ₹300 |

| 65 Kg-90 Kg | ₹2,000 | ₹500 |

| 90 Kg-135 Kg | ₹3,000 | ₹800 |

| More than 135 Kg | ₹3,500 | ₹800 |

| An old vehicle transferring to Arunachal Pradesh from some other state | Arunachal Pradesh's tax is computed by depreciating the other province's tax by 7% annually. | After depreciating the other province's tax by 7% every year, Arunachal Pradesh calculates its tax. |

Road Tax for Four-Wheelers

| Vehicle Price | The one-time tax rate for 15 years | Every 5 years after 15 years tax |

| Up to ₹3 Lakh | 2.5% | ₹3,000 |

| Between ₹3 Lakh and ₹5 Lakh | 2.7% | ₹3,500 |

| Between ₹5 Lakh and ₹10 Lakh | 3% | ₹4,000 |

| Between ₹10 Lakh and ₹15 Lakh | 3.5% | ₹4,500 |

| Between ₹15 Lakh and ₹18 Lakh | 4% | ₹5,000 |

| Between ₹18 Lakh and ₹20 Lakh | 4.5% | ₹6,000 |

| More than ₹20 Lakh | 6.5% | ₹10,000 |

| Old vehicles transferred to Arunachal Pradesh must be registered. | One-time tax is calculated after depreciating the current value of the car by 7%. | The one-time tax is 7% of the vehicle's current value. |

Road Tax for Commercial Vehicles

| Vehicle seating capacity | Annual Tax | Quarterly Tax |

| (Up to) 3 passengers | ₹800 | ₹250 |

| (Between) 4 and 6 passengers | ₹1,600 | ₹500 |

| Four-wheeled vehicles with a passenger-carrying capacity of 6 or fewer are licensed to operate in one city or region | ₹2,400 | ₹700 |

| A 4-wheeler vehicle with a licence to operate all over the state and a passenger-carrying capacity of 6 or fewer persons, | ₹4,000 | ₹1,200 |

| (Between) 7 and 12 passengers | ₹5,000 | ₹1,500 |

| (Between) 13 and 30 persons | ₹7,000 | ₹2,000 |

| (More than) 30 passengers | ₹7,000 + ₹80 for every seat above 30 | ₹2,000 + ₹20 for every seat above 30 |

| Deluxe Express buses with over 30 passengers | ₹8,000 + ₹80 for every seat above 30 | ₹2,000 + ₹20 for every seat above 30 |

| A/C super deluxe bus with over 30 seats. | ₹40,000 | ₹11,000 |

Road Tax for Other State Vehicles

| Vehicle Type | Road Tax Imposed |

| Light Motor Vehicles | ₹700 |

| Medium Goods Vehicles | ₹1,200 |

| Heavy Goods Vehicles | ₹2,000 |

How to Pay Road Tax Online in Arunachal Pradesh?

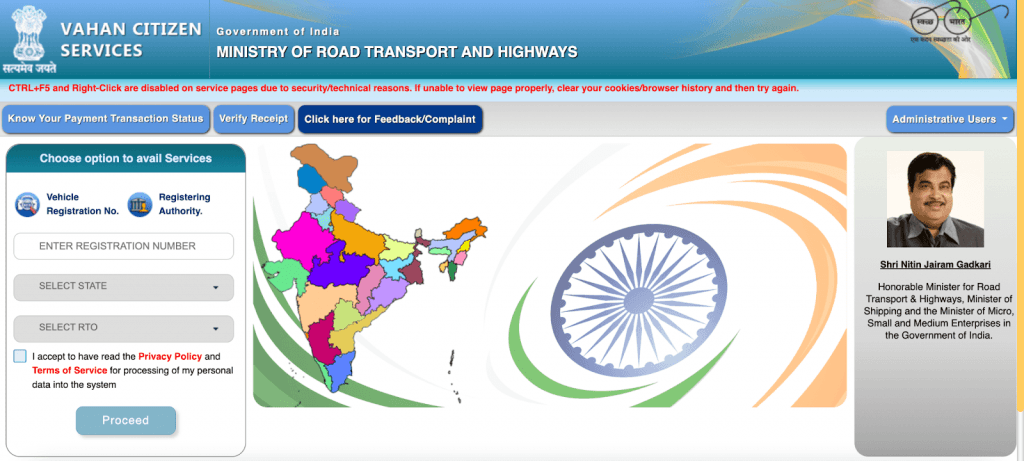

Paying road tax online in Arunachal Pradesh is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

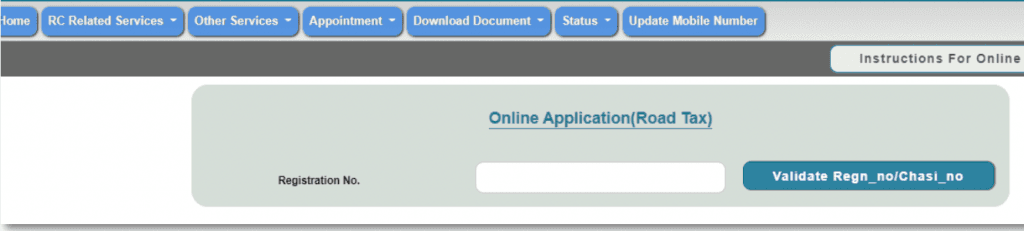

Step 1: Visit the Vahan Citizen Services Portal, you can pay your Arunachal Pradesh road tax within a few minutes.

Step 2: Enter your vehicle’s registration number, State, and RTO.

Step 3: Click on ‘I accept’ followed by ‘Proceed.’

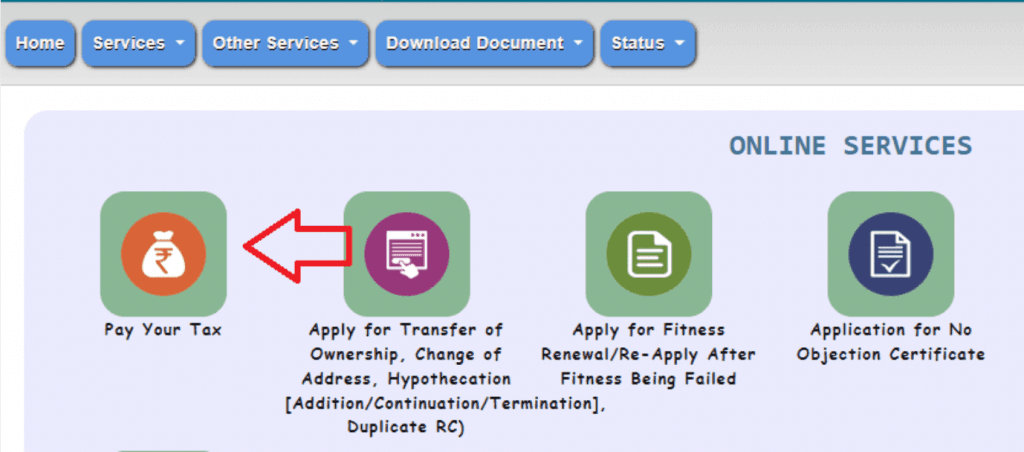

Step 4: Click on ‘Pay Your Tax.’

Step 5: Enter your registration number.

Step 6: Now you can pay your road tax through the payment gateway that appears on your screen.

Step 7: Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Arunachal Pradesh?

If you’ve failed to pay your road tax within the stipulated time, you will be faced with a fine of not less than ₹500 but which may extend to ₹5,000.

The Bottom Line

As we conclude this guide to pay your road tax online in Arunachal Pradesh, we’re certain that you’re equipped with all the necessary information to do so seamlessly. However, if you get confused at any step along the way, feel free to come back to this blog and read through the steps again!

FAQs

Q: How often do I need to pay road tax in Arunachal Pradesh?

A: You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q: Which State in India has the highest amount of road tax?

A: Karnataka charges the highest amount of road tax in India.

Q: Is the road tax refund process online?

A: Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q: Where can I check the status of road tax in Arunachal Pradesh?

A: You can check the road tax status in Arunachal Pradesh on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Q: What vehicles are exempted from paying road tax in Arunachal Pradesh?

A: There are no road tax exemptions in Arunachal Pradesh.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car