A Comprehensive Guide to Road Tax in Rajasthan

Updated on: 26th July, 2023 IST

Rajasthan, a land of rich heritage and vibrant culture, is renowned for its magnificent palaces, captivating forts, and mesmerising desert landscapes. A well-connected road infrastructure plays a vital role in facilitating seamless travel and transportation throughout this majestic state. Understanding and complying with the Rajasthan road tax system is crucial for its residents.

As a proud resident of Rajasthan, it is important to stay updated on road tax regulations. In this blog, we have simplified the process for you to conveniently pay road taxes online. Read on to discover how you can easily fulfil your road tax obligations!

Table of Contents

How is Road Tax Calculated in Rajasthan?

The Rajasthan road tax or transport vehicle tax has several components basis which taxes are imposed on vehicles within the State.

The actual road tax amount is levied based on the following:

- Vehicle types, such as 2-wheeler, 3-wheeler, 4-wheeler, bus, tractor, trailer, or other State vehicles.

- Purpose of use, such as for personal transportation, goods transportation, or passenger transportation.

- Vehicle Model

- The vehicle’s seating capacity

- The vehicle’s engine capacity

- The vehicle’s ex-showroom price

- Fuel Type (Diesel or Petrol)

- Vehicle Age

- Additional Cess (if applicable)

Here’s how much road tax you need to pay in Rajasthan:

Road Tax for Two-Wheelers

| Engine Capacity | One-Time Road Tax (% of the cost of the vehicle) |

| Up to 200 cc | 8% |

| 200 cc-500 cc | 13% |

| 501 cc and above | 15% |

Road Tax for Three-Wheelers

| Seating Capacity | One-Time Road Tax |

| 1-3 passengers | ₹3,000 |

| 4 passengers | ₹6,000 |

| 5 passengers or more | ₹8,000 |

Road Tax for Four-Wheelers

| Engine Capacity | One-Time Road Tax (% of the cost of the vehicle) |

| Petrol (up to 80 cc) | 6% |

| Diesel (up to 80 cc) | 8% |

| Petrol (up to 1,200 cc) | 9% |

| Diesel (up to 1,200 cc) | 11% |

| Petrol (more than 1,200 cc) | 10% |

| Diesel (more than 1,200 cc) | 12% |

Road Tax for Commercial Vehicles

Here is a breakdown of the road tax that the Rajasthan government levies on Taxi cabs, Maxi cabs, Contract carriage permit vehicles, and Tourist permit vehicles:

| Seating Capacity | One-Time Road Tax (% of the cost of the vehicle) |

| Up to 13 passengers | 11% |

| 13-22 passengers (purchased as chassis) | 35% |

| 13-22 passengers (purchased with a complete body) | 26% |

Road Tax for Other Categories of Vehicles

| Types of Vehicles | Road Tax (% of the cost of the vehicle) |

| Construction Equipment Vehicles (excluding harvester) | 6% |

| Construction Equipment Vehicles (excluding harvester) | 7.5% |

| Cranes (purchased as an entire body) | 8% |

| Cranes (purchased as chassis) | 10% |

| Camper Van (purchased as an entire body) | 7.5% |

| Camper Van (purchased as a chassis) | 10% |

| Two-Wheelers or Three-Wheelers used by People with Disabilities | 0.30% (capped at ₹50) |

How to Pay Road Tax Online in Rajasthan?

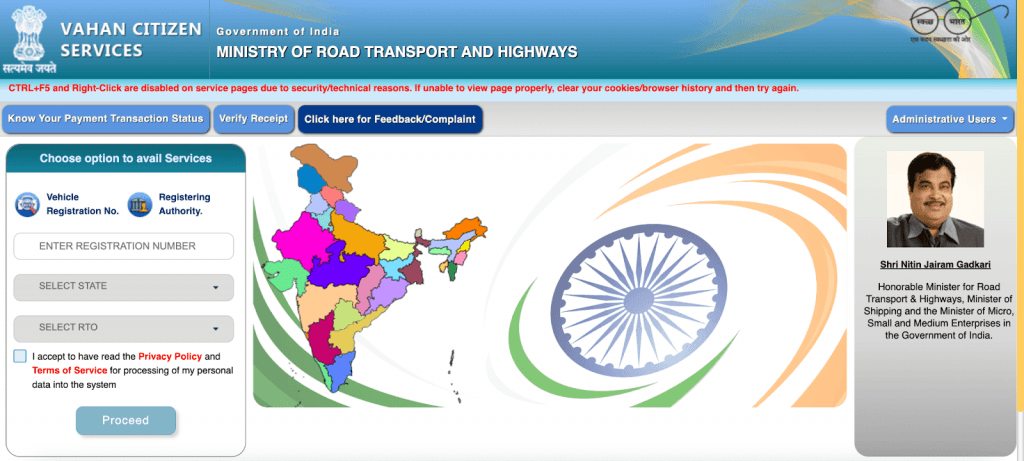

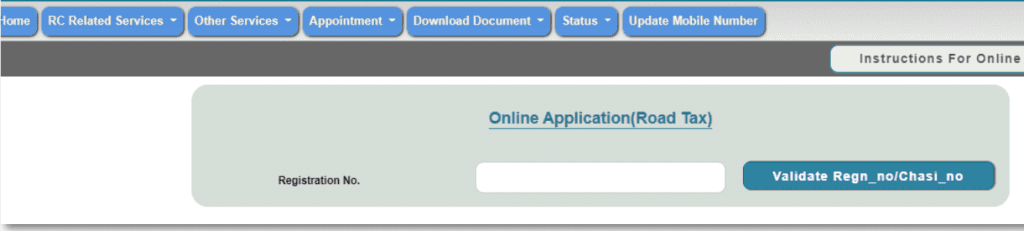

Paying road tax online in Rajasthan is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

- Visit the Vahan Citizen Services Portal.

- Enter your vehicle’s registration number, State, and RTO.

- Click on ‘I accept’ followed by ‘Proceed’.

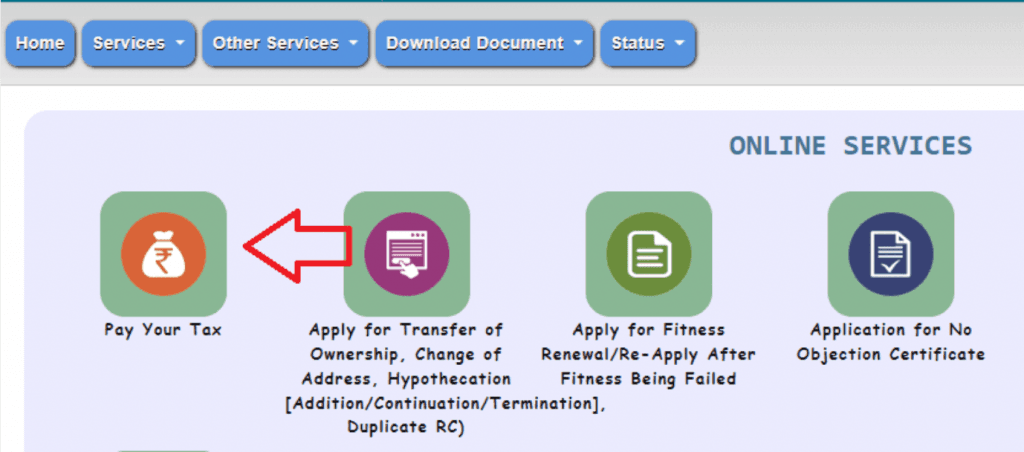

- Click on ‘Pay Your Tax.’

- Enter your registration number.

- Now you can pay your road tax through the payment gateway that appears on your screen.

- Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Rajasthan?

In Rajasthan, every vehicle owner is required by law to pay road tax. It is an essential payment that needs to be made to comply with the Rajasthan Motor Vehicle Taxation Act.

If you don't pay the road tax on time, you will be responsible for paying a penalty. The penalty amount is calculated as 5% of the tax that you owe for each month of delay or even part thereof.

For example, let's say your road tax is due on January 1st, and you fail to pay it until February 15th. In this case, you would have a delay of one and a half months. As a result, the penalty would be calculated as 5% of the tax amount for each month of delay, which in this case would be 7.5% (5% for one month plus an additional 2.5% for half a month).

The Bottom Line

As we wrap up this guide on paying your road tax online in Rajasthan, we are confident that you now have all the essential information to complete the process smoothly. If you ever feel confused at any point, you can always revisit this blog and go through the steps again for clarification!

FAQs

Q. What vehicles are exempted from paying road tax in Rajasthan?

Two and four-wheeled electric vehicles are exempted from paying road tax in Rajasthan.

Q. How often do I need to pay road tax in Rajasthan?

You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q. Which State in India has the highest amount of road tax?

Karnataka charges the highest amount of road tax in India.

Q. Is the road tax refund process online?

Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q. Where can I check the status of road tax in Rajasthan?

You can check the road tax status in Rajasthan on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car