Jharkhand Road Tax Guide: Rates & Online Payment

Updated on: 20th February, 2024 IST

The State of Jharkhand, located in eastern India, is known for its wildlife sanctuaries, dense forests, and mineral reserves. It features an extensive network of State and National Highways, ensuring seamless road connectivity throughout the region.

Driving around in your State is always a wholesome experience. However, it also requires you to adhere to the law of the land including paying your Jharkhand road tax on time.

In this comprehensive guide, we will help you pay your Jharkhand road tax online hassle-free, and within minutes!

Table of Contents

How is Road Tax Calculated in Jharkhand?

Each State chooses different parameters and rules to levy road taxes. In Jharkhand, the motor vehicle tax is calculated based on factors like the vehicle’s age, engine capacity, intended use, location, and model.

Road Tax for Two-Wheelers

| Stage of Registration | Percentage of one-time tax |

| Upon first registration or up to 1 year of age at registration | A road tax equal to 6% of the vehicle's cost before GST is due |

| The registered vehicle is between 1 and 2 years old | 95% of tax paid at registration |

| The registered vehicle is between two and three years old | 90% of tax paid at registration |

| The registered vehicle’s age is within 3 to 4 years | 85% of tax paid at registration |

| The registered vehicle is between 4 and 5 years old | 80% of tax paid at registration |

| The registered vehicle’s age is within 5 to 6 years | 75% of tax paid at registration |

| The registered vehicle is between 6 and 7 years old | 70% of tax paid at registration |

| The registered vehicle is between 7 and 8 years old | 65% of tax paid at registration |

| The registered vehicle’s age is within 8 to 9 years | 60% of tax paid at registration |

| The registered vehicle’s age ranges between 9 to 10 years | 55% of tax paid at registration |

| The registered vehicle’s age exceeds ten years | 50% of tax paid at registration |

Road Tax for Four-Wheelers

The road tax levied in Jharkhand is 6% of the vehicle's price, GST excluded. For a pre-owned car, an additional 3% tax is levied. Moreover, a further 15% is chargeable if the vehicle is priced above 15 lakhs, excluding GST.

| Duration since vehicle registration | The tax rate paid while registration |

| Within 1 to 2 years | 95% |

| Between 2 to 3 years | 90% |

| Within 3 to 4 years | 85% |

| Between 4 to 5 years | 80% |

| Within 5 to 6 years | 75% |

| Between 6 to 7 years | 70% |

| Within 7 to 8 years | 65% |

| Between 8 to 9 years | 60% |

| Within 9 to 10 years | 55% |

| Beyond 10 years since registration | 50% |

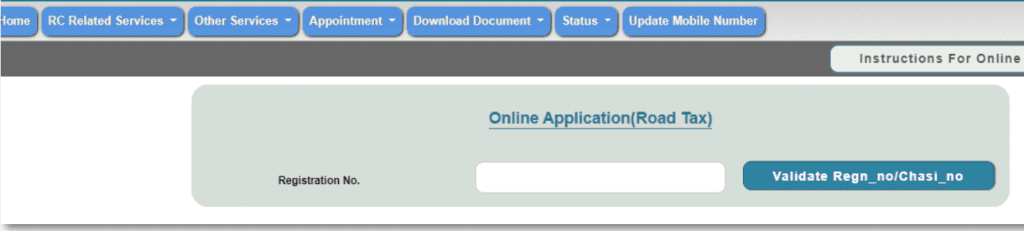

How to Pay Road Tax Online in Jharkhand?

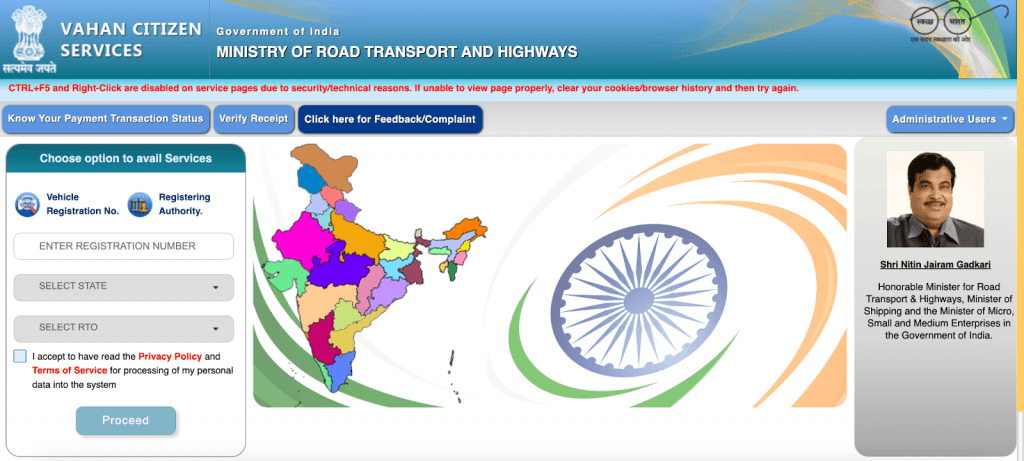

Paying road tax online in Jharkhand is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

Step 1 : Visit the official website of the Transport Department of Jharkhand.

Step 2 : Tap on the "Tax Payment" tab. You will be redirected to the Vahan Citizen Services Portal.

Step 3 : Enter your vehicle’s registration number, State, and RTO.

Step 4 : Click on ‘I accept’ followed by ‘Proceed.’

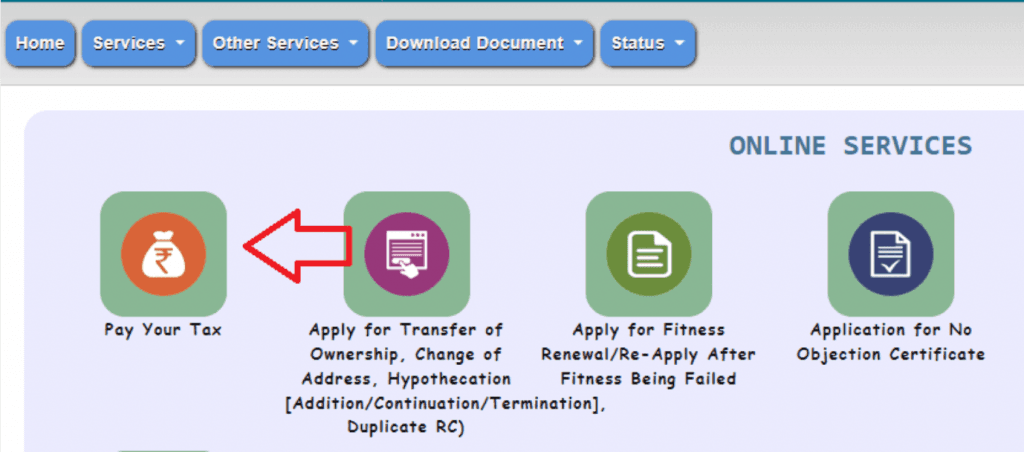

Step 5 : Click on ‘Pay Your Tax.’

Step 6 : Enter your registration number.

Step 7 : Now you can pay your road tax through the payment gateway that appears on your screen.

Step 8 : Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Jharkhand?

If you’ve failed to pay your road tax within the stipulated time, you will be faced with a fine. The fine amount varies depending on your vehicle, however, cannot exceed 100% of the taxes owed.

The Bottom Line

As we conclude this guide to pay your road tax online in Jharkhand, we’re certain that you’re equipped with all the necessary information to do so seamlessly. However, if you get confused at any step along the way, feel free to come back to this blog and read through the steps again!

FAQs

Q. How often do I need to pay road tax in Jharkhand?

You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q. Which State in India has the highest amount of road tax?

Karnataka charges the highest amount of road tax in India.

Q. Is the road tax refund process online?

Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q. Where can I check the status of road tax in Jharkhand?

You can check the road tax status in Jharkhand on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Q. What vehicles are exempted from paying road tax in Jharkhand?

Jharkhand exempts vehicles used for agricultural purposes from paying road tax.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car