Gujarat Road Tax Guide: Rates & Online Payment

Updated on: 20th February, 2024 IST

Gujarat, a vibrant state known for its idyllic cities and rich cultural heritage, places significant importance on a robust road network to ensure the smooth transportation of goods and people. Familiarising yourself with the Gujarat road tax system is crucial for all residents of this captivating state.

As a resident of Gujarat, it is essential to stay informed about the latest updates in the Gujarat road tax system. We have streamlined the process to enable you to conveniently pay road taxes online, right from the comfort of your home.

Table of Contents

How is Road Tax Calculated in Gujarat?

The Gujarat road tax or transport vehicle tax has several components basis which taxes are imposed on vehicles within the State.

The actual road tax amount is levied based on the following:

- Vehicle types, such as 2-wheeler, 3-wheeler, 4-wheeler, bus, tractor, trailer, or other State vehicles.

- Purpose of use, such as for personal transportation, goods transportation, or passenger transportation.

- Vehicle Model

- The vehicle’s seating capacity

- The vehicle’s engine capacity

- The vehicle’s ex-showroom price

- Fuel Type (Diesel or Petrol)

- Vehicle Age

- Additional Cess (if applicable)

Here’s how much road tax you need to pay in Gujarat:

Road Tax for Two-Wheelers

| Age of the Motorcycle | Amount to be paid (% of cost of the vehicle) |

| New vehicles and those less than 8 years old | 6% |

| 8 years-15 years | 15% |

| Vehicles older than 15 years | 1% |

Road Tax for Three-Wheelers

| Seating Capacity of the Autoriskaw | Amount to be paid (% of cost of the vehicle) |

| Up to 3 people | 2.50% |

| Between 3 and 6 people | 6% |

Road Tax for Four-Wheelers

| Type of Vehicle | Amount to be paid (% of cost of the vehicle) |

| Four-wheelers, LMVs, private cars, station wagons, jeeps, and taxis | 6% |

Road Tax for Commercial Vehicles

Gujarat has different tax slabs for commercial vehicles based on the different categories. These are as follows:

| Type of Vehicle | Amount to be paid (% of cost of the vehicle) |

| Goods Vehicles (weighing up to 7,500 kg) | 6% |

| Medium Goods Vehicles (weighing up to 7,501 kg-12,000 kg) | 8% |

| Heavy Goods Vehicles (weighing above 12,001 kg) | 12% |

| MaxiCab and Buses(seating capacity between 7-8) | 8% |

| MaxiCab and Buses (seating capacity between 9-12) | 12% |

| Tractors (for commercial use) | 3% |

Additionally, Gujarat also levies a recurring tax on some commercial vehicles based on their category. These recurring taxes are as follows:

| Contract Carriage | Annual Rate Per Seat |

| Buses (seating capacity of up to 12) | 8% (for seating capacity between 7-8) 12% (for seating capacity between 9-12) |

| Buses (seating capacity between 12-20) | ₹4,500 |

| Buses (seating capacity of more than 20) | ₹4,500 |

| Luxury Buses (seating capacity of up to 20) | ₹4,500 |

| Luxury Buses (seating capacity of more than 20) | ₹7,800 |

| Sleeper Buses (capacity of up to 20) | ₹7,800 |

| Sleeper Buses (capacity of more than 20) | ₹13,200 |

| Goods Vehicles (weighing more than 7,500 kg) | ₹800 per 1,000 kg OR part thereof |

| Tractor-Prime Mover (weighing above 2,000 kg fitted with Crane, Rig, or Compressor) | ₹2,000 + ₹400 per 1,000 kg OR part thereof exceeding 2,000 kg |

| Construction Vehicle (Crane, Rig, Loader, Fork Lift, and Backhoe) | ₹2,000 + ₹400 per 1,000 kg OR part thereof exceeding 2,000 kg |

| Tow Truck | ₹2,000 + ₹400 per 1,000 kg OR part thereof exceeding 2,000 kg |

| Special Purpose Vehicles | ₹2,000 + ₹400 per 1,000 kg OR part thereof exceeding 2,000 kg |

| Stage Carriages (passenger vehicles) | ₹1,200 for the first 9 seats + ₹80 for every subsequent passenger and 9 standing passengers at ₹40 each |

Road Tax for Our-of-State Vehicles

| Type of Vehicle | Duration | Tax Calculation |

| Luxury Buses or Tourist Cabs/Buses | Less than 1 week | 4% of the Annual rate per week |

| Luxury Buses or Tourist Cabs/Buses | More than 1 week and less than 1 month | 1/12 of the Annual rate |

Road Tax for Taxis

| Passenger Capacity | Annual Rate | Provision for Out-of-State Vehicles |

| Up to 3 | ₹300 | 4% of the annual rate per week or a part of it |

| Up to 4 | ₹1,200 | 4% of the annual rate per week or a part of it |

| Up to 5 | ₹1,350 | 4% of the annual rate per week or a part of it |

| Up to 6 | ₹1,500 | 4% of the annual rate per week or a part of it |

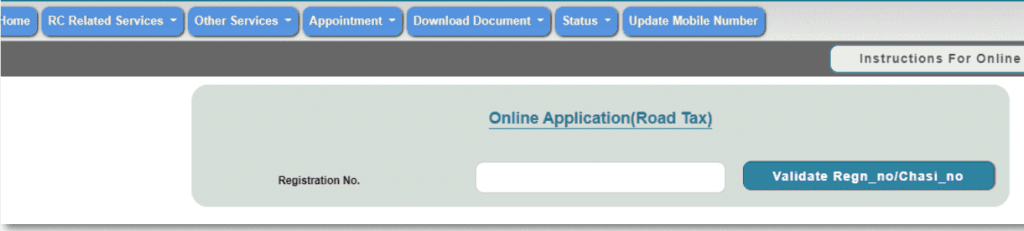

How to Pay Road Tax Online in Gujarat?

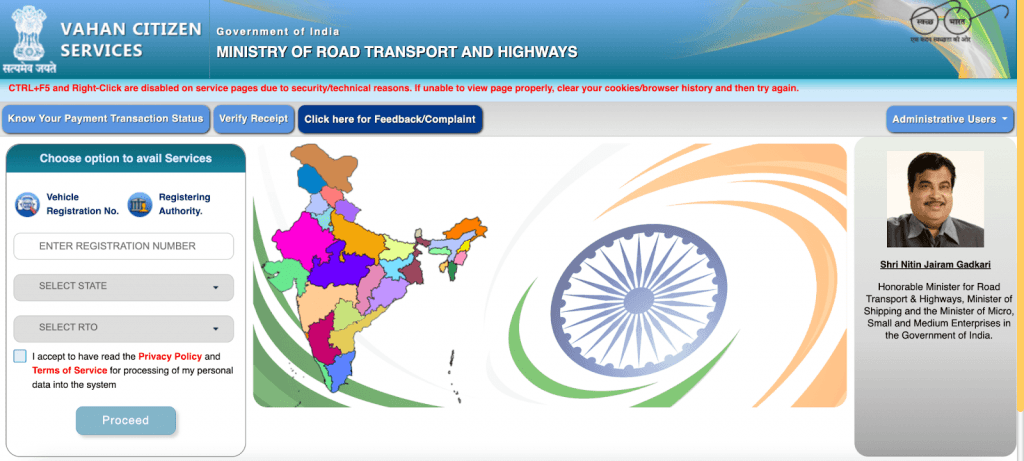

Paying road tax online in Gujarat is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

Step 1: Visit the Vahan Citizen Services Portal.

Step 2: Enter your vehicle’s registration number, State, and RTO.

Step 3: Click on ‘I accept’ followed by ‘Proceed.’

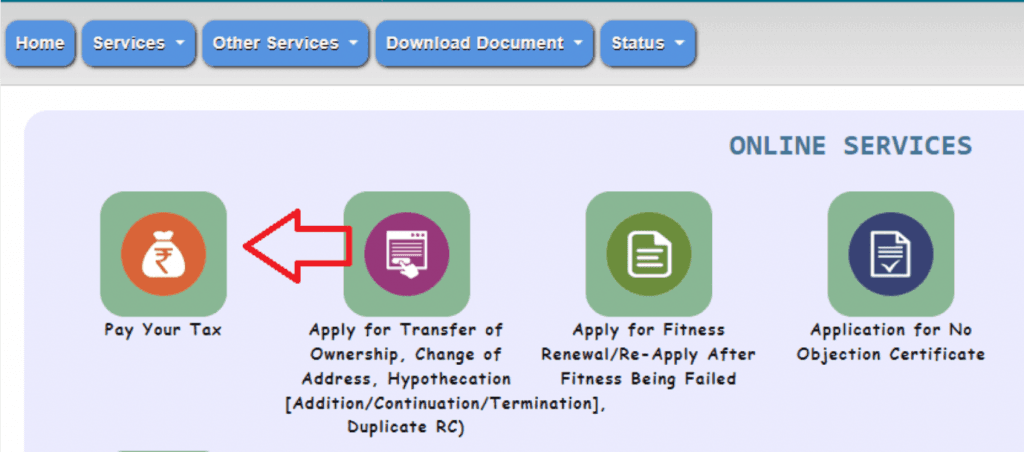

Step 4: Click on ‘Pay Your Tax.’

Step 5: Enter your registration number.

Step 6: Now you can pay your road tax through the payment gateway that appears on your screen.

Step 7: Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Gujarat?

If you’ve failed to pay your road tax within the stipulated time, you will be penalised a certain additional amount based on the extent of the delay. Here is a breakdown of the same:

| Delay | Penalty |

| More than 3 months | 18% of the total road tax amount owed to the Government |

The Bottom Line

As we conclude this guide on paying your road tax in Gujarat, we are confident that you now possess all the necessary information to navigate the process with ease. In case you encounter any confusion along the way, you can always revisit this blog to review the steps and find clarity.

FAQs

Q: What vehicles are exempted from paying road tax in Gujarat?

A: Two and four-wheeled electric vehicles are exempted from paying road tax in Gujarat.

Q: How often do I need to pay road tax in Gujarat?

A: You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q: Which State in India has the highest amount of road tax?

A: Karnataka charges the highest amount of road tax in India.

Q: Is the road tax refund process online?

A: Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q: Where can I check the status of road tax in Gujarat?

A: You can check the road tax status in Gujarat on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car