A Comprehensive Guide to Road Tax in Mizoram

Updated on: 26th July, 2023 IST

Mizoram relies on a well-connected road infrastructure that connects the magnificent Durtlang Hills, the picturesque Phawngpui Peak, and the serene Vantawng Falls to the rest of the State. Understanding and complying with the Mizoram road tax system is of utmost importance for the residents of the State.

As a resident of Mizoram, it is crucial to stay updated on road tax regulations. In this article, we have streamlined the process for you to conveniently pay road taxes online. Keep reading to discover how you can easily fulfil your road tax obligations.

Table of Contents

How is Road Tax Calculated in Mizoram?

The Mizoram road tax or transport vehicle tax has several components basis which taxes are imposed on vehicles within the State.

The actual road tax amount is levied based on the following:

- Vehicle types, such as 2-wheeler, 3-wheeler, 4-wheeler, bus, tractor, trailer, or other State vehicles.

- Purpose of use, such as for personal transportation, goods transportation, or passenger transportation.

- Vehicle Model

- The vehicle’s seating capacity

- The vehicle’s engine capacity

- The vehicle’s ex-showroom price

- Fuel Type (Diesel or Petrol)

- Vehicle Age

- Additional Cess (if applicable)

Here’s how much road tax you need to pay in Mizoram:

Road Tax for Two-Wheelers

For vehicles less than 200 cc:

| Age of Vehicle (in years) | Up to 100 cc | Above 100 cc |

| New and up to 1 year | ₹1,500 | ₹3,000 |

| 1-2 | ₹1,400 | ₹2,800 |

| 2-3 | ₹1,300 | ₹2,600 |

| 3-4 | ₹1,200 | ₹2,400 |

| 4-5 | ₹1,100 | ₹2,200 |

| 5-6 | ₹1,000 | ₹2,000 |

| 6-7 | ₹900 | ₹1,800 |

| 7-8 | ₹800 | ₹1,600 |

| 8-9 | ₹700 | ₹1,400 |

| 9-10 | ₹600 | ₹1,200 |

| 10-11 | ₹500 | ₹1,000 |

| 11-12 | ₹400 | ₹800 |

| 12-13 | ₹300 | ₹600 |

| 13-14 | ₹200 | ₹400 |

| More than 14 years | ₹100 | ₹200 |

For vehicles more than 200 cc:

| Age of Vehicle (in years) | Above 200 cc | Above 300 cc |

| New and up to 1 year | ₹4,500 | ₹6,000 |

| 1-2 | ₹4,200 | ₹5,600 |

| 2-3 | ₹3,900 | ₹5,200 |

| 3-4 | ₹3,600 | ₹4,800 |

| 4-5 | ₹3,300 | ₹4,400 |

| 5-6 | ₹3,000 | ₹4,000 |

| 6-7 | ₹2,700 | ₹3,600 |

| 7-8 | ₹2,400 | ₹3,200 |

| 8-9 | ₹2,100 | ₹2,800 |

| 9-10 | ₹1,800 | ₹2,400 |

| 10-11 | ₹1,500 | ₹2,000 |

| 11-12 | ₹1,200 | ₹1,600 |

| 12-13 | ₹900 | ₹1,200 |

| 13-14 | ₹600 | ₹800 |

| More than 14 years | ₹300 | ₹400 |

Road Tax for Four-Wheelers

For vehicles less than 1,000 cc:

| Age of Vehicle (in years) | Up to 800 cc | 801 cc-1,000 cc |

| New and up to 1 year | ₹11,250 | ₹12,750 |

| 1-2 | ₹10,500 | ₹11,900 |

| 2-3 | ₹9,750 | ₹11,050 |

| 3-4 | ₹9,000 | ₹10,200 |

| 4-5 | ₹8,250 | ₹9,350 |

| 5-6 | ₹7,500 | ₹8,500 |

| 6-7 | ₹6,750 | ₹7,650 |

| 7-8 | ₹6,000 | ₹6,800 |

| 8-9 | ₹5,250 | ₹5,950 |

| 9-10 | ₹4,500 | ₹5,100 |

| 10-11 | ₹3,750 | ₹4,250 |

| 11-12 | ₹3,000 | ₹3,400 |

| 12-13 | ₹2,250 | ₹2,550 |

| 13-14 | ₹1,500 | ₹1,700 |

| More than 14 years | ₹750 | ₹850 |

For vehicles between 1,001 cc-3,000 cc:

| Age of Vehicle (in years) | 1,001 cc-2,000 cc | 2,001 cc-3,000 cc |

| New and up to 1 year | ₹15,000 | ₹17,250 |

| 1-2 | ₹14,000 | ₹16,100 |

| 2-3 | ₹13,000 | ₹14,950 |

| 3-4 | ₹12,000 | ₹13,800 |

| 4-5 | ₹11,000 | ₹12,650 |

| 5-6 | ₹10,000 | ₹11,500 |

| 6-7 | ₹9,000 | ₹10,350 |

| 7-8 | ₹8,000 | ₹9,200 |

| 8-9 | ₹7,000 | ₹8,050 |

| 9-10 | ₹6,000 | ₹6,900 |

| 10-11 | ₹5,000 | ₹5,700 |

| 11-12 | ₹4,000 | ₹4,600 |

| 12-13 | ₹3,000 | ₹3,450 |

| 13-14 | ₹2,000 | ₹2,300 |

| More than 14 years | ₹1,000 | ₹1,500 |

For vehicles more than 3,000 cc:

| Age of Vehicle (in years) | Above 3,001 cc |

| New and up to 1 year | ₹19,500 |

| 1-2 | ₹18,200 |

| 2-3 | ₹16,900 |

| 3-4 | ₹15,600 |

| 4-5 | ₹14,300 |

| 5-6 | ₹13,000 |

| 6-7 | ₹11,700 |

| 7-8 | ₹10,400 |

| 8-9 | ₹9,100 |

| 9-10 | ₹9,800 |

| 10-11 | ₹6,500 |

| 11-12 | ₹5,200 |

| 12-13 | ₹3,900 |

| 13-14 | ₹2,600 |

| More than 14 years | ₹1,300 |

Road Tax for Commercial Vehicles

| Vehicle Type | Tax Rate |

| Light Commercial Vehicles | ₹500 |

| Medium Commercial Vehicles | ₹1,000 |

| Heavy Commercial Vehicles | ₹2,000 |

Road Tax for Out-of-State Vehicles

| Vehicle Type | Tax Rate (% of Ex-showroom Price) |

| Private Cars and Two-Wheelers | 5% |

| Commercial Vehicles | 8% |

How to Pay Road Tax Online in Mizoram?

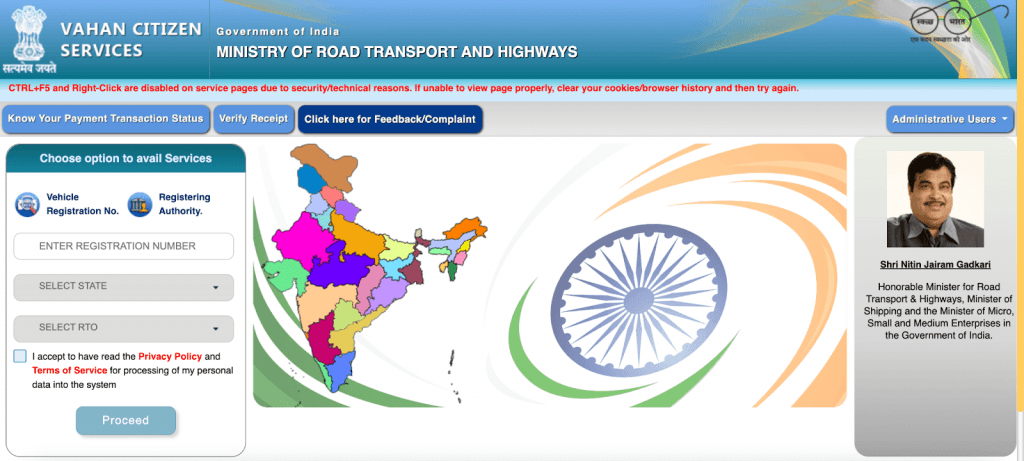

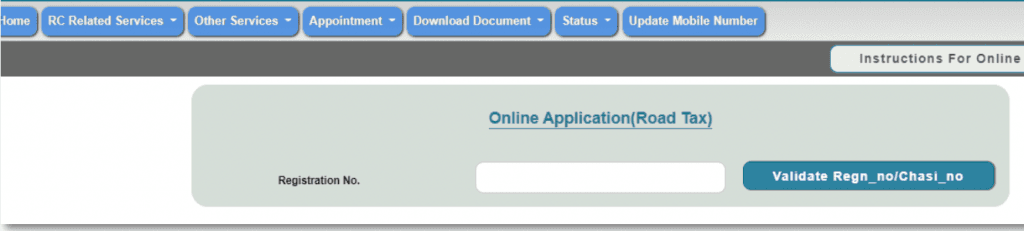

Paying road tax online in Mizoram is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

- Visit the Vahan Citizen Services Portal.

- Enter your vehicle’s registration number, State, and RTO.

- Click on ‘I accept’ followed by ‘Proceed’.

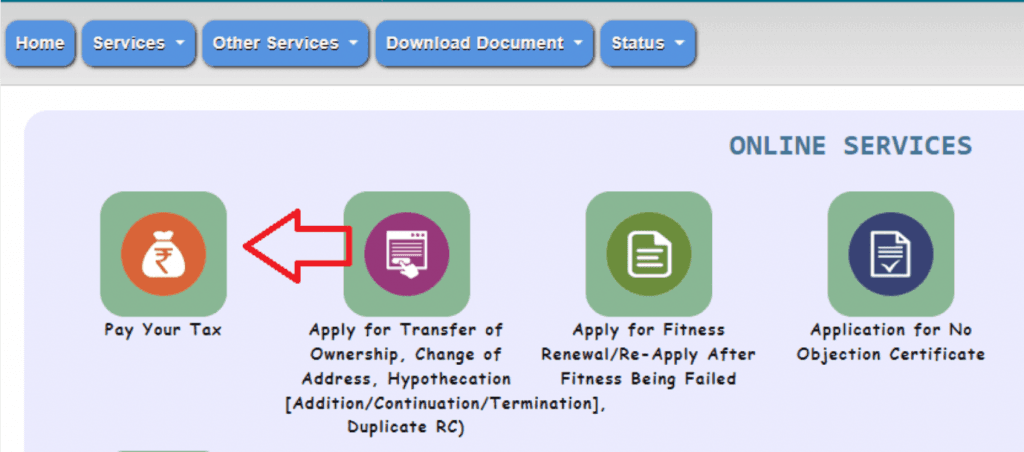

- Click on ‘Pay Your Tax.’

- Enter your registration number.

- Now you can pay your road tax through the payment gateway that appears on your screen.

- Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Mizoram?

Not paying your road tax in Mizoram can lead to a penalty. It's important to fulfil your road tax obligations to avoid any legal issues and keep your vehicle safe. Here is a breakdown of the road tax penalty in Mizoram:

| Vehicle Type | Applicable Penalty |

| Two-Wheelers | ₹200 for each month or part thereof |

| Three-Wheelers | ₹500 for each month or part thereof |

| Medium and Heavy Motor Vehicles | ₹1,000 for each month or part thereof |

The Bottom Line

As we wrap up this guide on paying your road tax online in Mizoram, we are confident that you now have all the essential information to complete the process smoothly. If you ever feel confused at any point, you can always revisit this blog and go through the steps again for clarification!

FAQs

Q. What vehicles are exempted from paying road tax in Mizoram?

Two and four-wheeled electric vehicles are exempted from paying road tax in Mizoram.

Q. How often do I need to pay road tax in Mizoram?

You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q. Which State in India has the highest amount of road tax?

Karnataka charges the highest amount of road tax in India.

Q. Is the road tax refund process online?

Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q. Where can I check the status of road tax in Mizoram?

You can check the road tax status in Mizoram on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car