Andhra Pradesh Road Tax Guide: Rates & Online Payment

Updated on: 20th February, 2024 IST

Dotted with vibrant urban hubs and with a rich cultural heritage, roads in Andhra Pradesh play a pivotal role in ensuring the smooth movement of goods, transportation, and people. Just like the state's thriving infrastructure, understanding and complying with the Andhra Pradesh road tax system is vital for residents.

If you reside in Andhra Pradesh, you need to be well-informed about the functioning of the road tax system. We have taken the initiative to simplify the process for you to understand and pay road taxes online in just a few minutes!

Table of Contents

How is Road Tax Calculated in Andhra Pradesh?

The Andhra Pradesh road tax or transport vehicle tax has several components basis which taxes are imposed on vehicles within the State.

The actual road tax amount is levied based on the following:

- Vehicle types, such as 2-wheeler, 3-wheeler, 4-wheeler, bus, tractor, trailer, or other State vehicles.

- Purpose of use, such as for personal transportation, goods transportation, or passenger transportation.

- Vehicle Model

- The vehicle’s seating capacity

- The vehicle’s engine capacity

- The vehicle’s ex-showroom price

- Fuel Type (Diesel or Petrol)

- Vehicle Age

- Additional Cess (if applicable)

Here’s how much road tax you need to pay in Andhra Pradesh:

Road Tax for Two-Wheelers

| Vehicle Age | Tax Applicable (on the total cost of the vehicle) |

| New Vehicle | 9% |

| Up to 2 years | 8% |

| 2 - 3 years | 7% |

| 3 - 4 years | 6% |

| 4 - 5 years | 5% |

| 5 - 6 years | 4% |

| 6 - 7 years | 3.50% |

| 7 - 8 years | 3% |

| 8 - 9 years | 2.50% |

| 9 - 10 years | 2% |

| 10 - 11 years | 1.50% |

| Greater than 11 years | 1% |

Road Tax for Four-Wheelers

| Vehicle Age | Lifetime road tax for vehicles under ₹10 lakh (%) | Lifetime road tax for vehicles over ₹10 lakh (%) |

| New Vehicle | 12% | 14% |

| Up to 2 years | 11% | 13% |

| 2 - 3 years | 10.50% | 12.50% |

| 3 - 4 years | 10% | 12% |

| 4 - 5 years | 9.50% | 11.50% |

| 5 - 6 years | 9% | 11% |

| 6 - 7 years | 8.50% | 10.50% |

| 7 - 8 years | 8% | 10% |

| 8 - 9 years | 7.50% | 9.50% |

| 9 - 10 years | 7% | 9% |

| 10 - 11 years | 6.50% | 8.50% |

| 11 - 12 years | 6% | 8% |

| Greater than 12 years | 5.50% | 7.50% |

Road Tax for Commercial Vehicles

| Age of Vehicle | Lifetime Tax (% of total vehicle cost) |

| New | 7.50% |

| 3-6 years | 6.50% |

| >6 years | 4% |

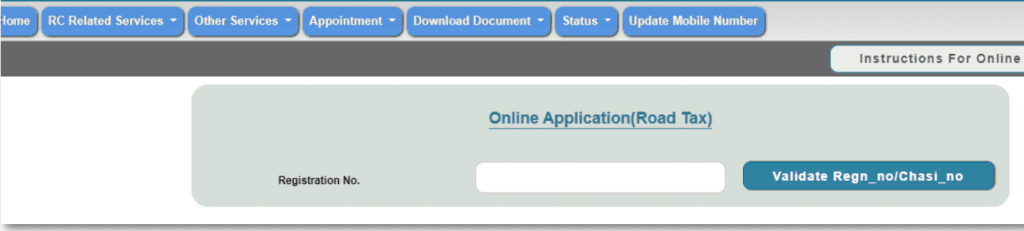

How to Pay Road Tax Online in Andhra Pradesh?

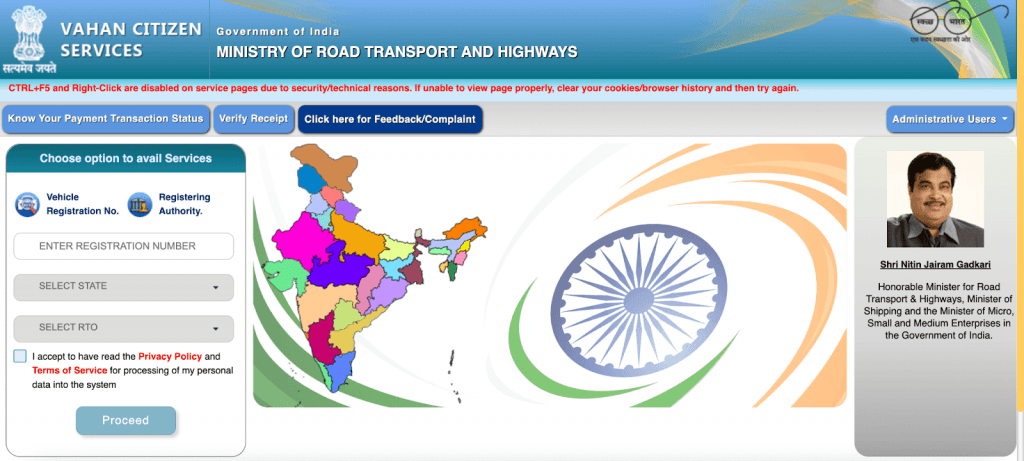

Paying road tax online in Andhra Pradesh is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

Step 1: Visit the Vahan Citizen Services Portal.

Step 2: Enter your vehicle’s registration number, State, and RTO.

Step 3: Click on ‘I accept’ followed by ‘Proceed.’

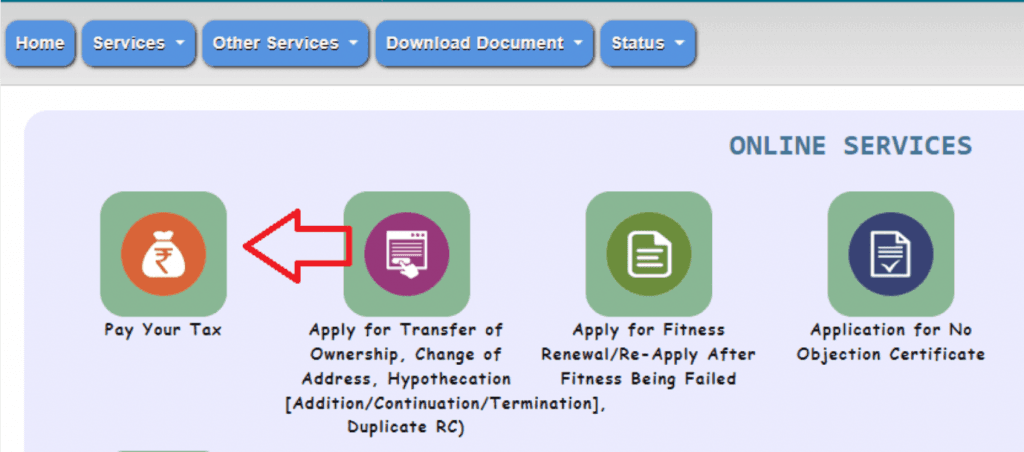

Step 4: Click on ‘Pay Your Tax.’

Step 5: Enter your registration number.

Step 6: Now you can pay your road tax through the payment gateway that appears on your screen.

Step 7: Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Andhra Pradesh?

If you’ve failed to pay your road tax within the stipulated time, you will be penalised a certain additional amount based on the extent of the delay.

| Period | Penalty |

| Within 1 month after the due date | Not exceeding one-half of the quarterly tax |

| Within 2 months after the due date | Not exceeding the amount of quarterly tax |

| Within 3 months after the due date | Not exceeding 1.5 times the amount of quarterly tax |

| Within 4 months after the due date | Not exceeding 2 times the amount of quarterly tax |

| Within 5 months after the due date | Not exceeding 2.5 times the amount of quarterly tax |

| After 5 months | Not exceeding 3 times the amount of quarterly tax |

The Bottom Line

As we wrap up this guide on paying your road tax online in Andhra Pradesh, we are confident that you now have all the essential information to complete the process smoothly. If you ever feel confused at any point, you can always revisit this blog and go through the steps again for clarification!

FAQs

Q: What vehicles are exempted from paying road tax in Andhra Pradesh?

A: Two and four-wheeled electric vehicles are exempted from paying road tax in Andhra Pradesh.

Q: How often do I need to pay road tax in Andhra Pradesh?

A: You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State.

Q: Which State in India has the highest amount of road tax?

A: Karnataka charges the highest amount of road tax in India.

Q: Is the road tax refund process online?

A: Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q: Where can I check the status of road tax in Andhra Pradesh?

A: You can check the road tax status in Andhra Pradesh on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car