A Comprehensive Guide to Road Tax in Meghalaya

Updated on: 26th July, 2023 IST

Dotted with the breathtaking Garo and Khasi hills, Meghalaya is a State in Northeast India. This state is known for its biodiversity and is a joy to live in and features a well-developed road network that allows residents and tourists to travel seamlessly.

If you are a resident of this State, it is important for you to know the working of the Meghalaya road tax system. We’ve compiled a guide for you to understand and pay road taxes online hassle-free and within minutes!

Table of Contents

How is Road Tax Calculated in Meghalaya?

Each State chooses different parameters and rules to levy road taxes. In Meghalaya, the motor vehicle tax is calculated based on factors like the vehicle’s age, make and manufacturer, fuel type, length and width of the vehicle, engine capacity, purpose, and place of manufacture.

Road Tax for Two-Wheelers

| Weight of vehicle | Tax for 10 years | Tax per 5 years after 10 years |

| Below 65 Kg unladen | ₹1,100 | ₹310 |

| Below 65 Kg to 90 Kg unladen | ₹1,800 | ₹470 |

| 90 Kg to 135 Kg | ₹2,500 | ₹630 |

| Above 135 Kg | ₹2,990 | - |

Road Tax for Four-Wheelers

| Original Cost of Vehicle | Tax for 10 years | Tax per 5 years after 10 years |

| Up to Rs.3 lakh | 4% of the original cost | ₹6,000 |

| More than Rs.3 lakh | 6% of the original cost | ₹9,000 |

| More than Rs.15 lakh | 8% of the original cost | ₹13,550 |

| More than Rs.20 lakh | 10% of the original cost | ₹16,500 |

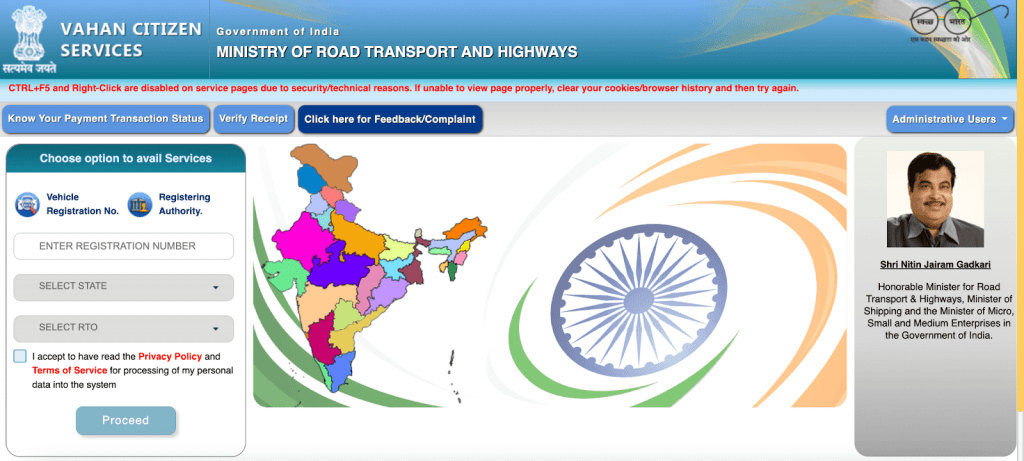

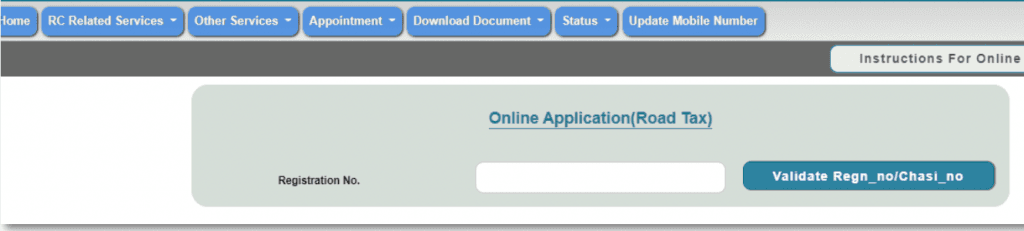

How to Pay Road Tax Online in Meghalaya?

Paying road tax online in Meghalaya is quite simple using the Vahan 4.0 portal. To get started, read these steps and pay up within minutes!

- Visit the Vahan Citizen Services Portal.

- Enter your vehicle’s registration number, State, and RTO.

- Click on ‘I accept’ followed by ‘Proceed’.

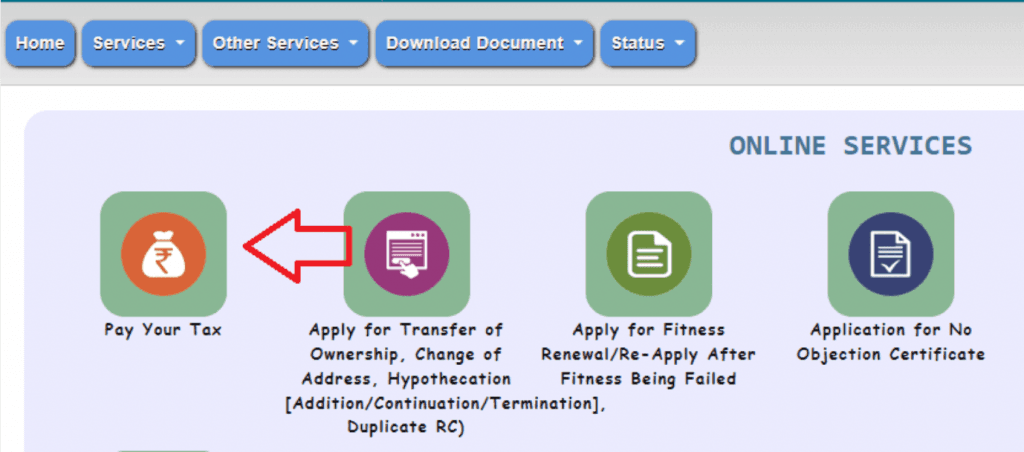

- Click on ‘Pay Your Tax.’

- Enter your registration number.

- Now you can pay your road tax through the payment gateway that appears on your screen.

- Once you’ve made your payment successfully, you can print or download the receipt.

What is the Road Tax Penalty in Meghalaya?

If you’ve failed to pay your road tax within the stipulated time, you will be faced with a fine based on the kind of vehicle you possess.

The Bottom Line

As we conclude this guide to pay your road tax online in Meghalaya, we’re certain that you’re equipped with all the necessary information to do so seamlessly. However, if you get confused at any step along the way, feel free to come back to this blog and read through the steps again!

FAQs

Q. How often do I need to pay road tax in Meghalaya?

You need to pay the road tax only once when you purchase a new vehicle. If you delay the payment beyond the specified window, you may incur penalties. If you transfer your vehicle from one State to another, you need to re-register your vehicle and pay the road tax in the new State. Note: You can choose to pay road tax in Meghalaya on a quarterly, half-yearly, or annual basis, after 7 days or before 45 days from the beginning of the quarter or half-year.

Q. Which State in India has the highest amount of road tax?

Karnataka charges the highest amount of road tax in India.

Q. Is the road tax refund process online?

Unfortunately, the road tax refund process is not online. If you wish to apply for a road tax refund, you need to visit the nearest RTO and complete the process of applying for a road tax refund.

Q. Where can I check the status of road tax in Meghalaya?

You can check the road tax status in Meghalaya on the Parivahan website. You only require the registration number of your vehicle to check and pay road tax online.

Q. What vehicles are exempted from paying road tax in Meghalaya?

Two and four-wheeled electric vehicles are exempted from paying road tax in Meghalaya.

Check the Tax Rates in Other States

Buy recently added cars

Other Blogs

- Recent

- Featured

Popular Cities to Sell Car